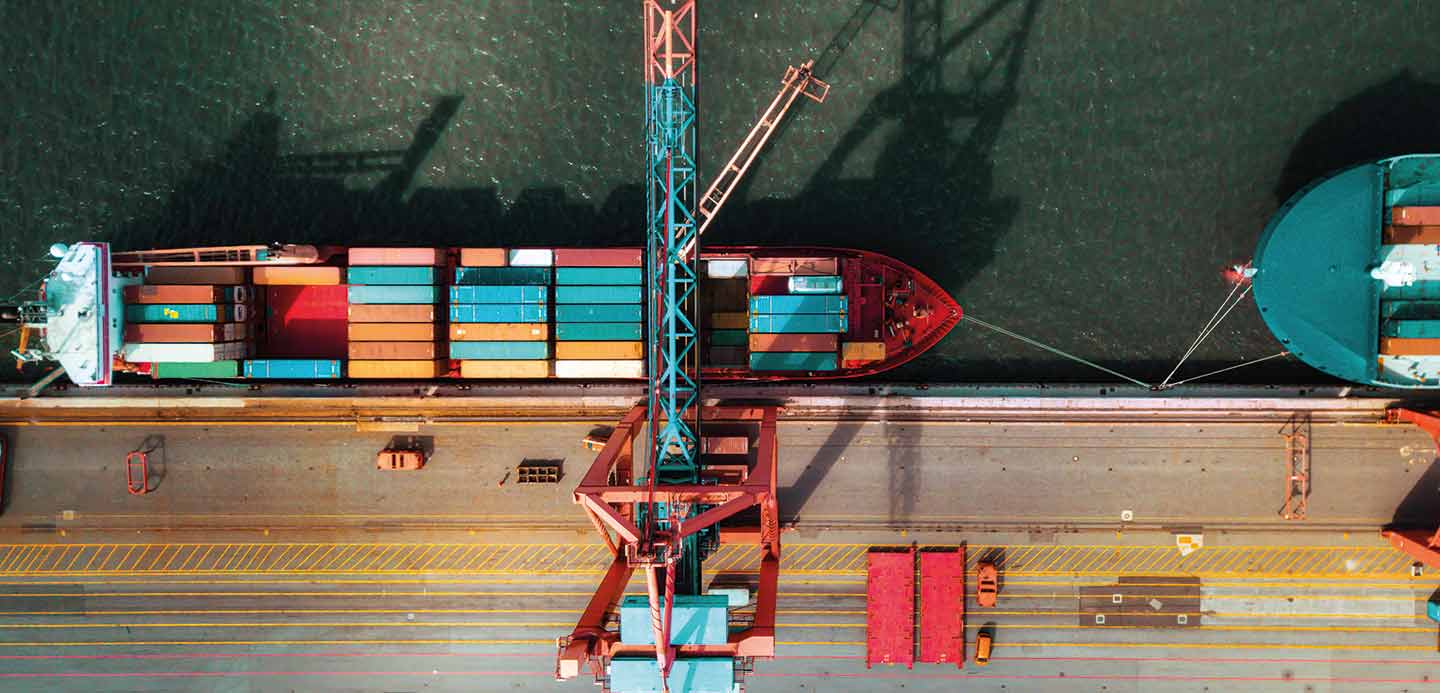

Digital Frontiers 2030: Unlocking opportunities from Southeast As...

Article

From a humble beginning in a small fishing community in Selangor where it sold seashell powder to f...

At HSBC, we believe in your vision just as much as you do. Through our lending solutions, we aim to give you access to the funding you need to help you take your business to an even greater level of success.