- Article

- Optimising Sales

- Enable Growth

What is a Letter of Credit (LC)?

What is a Letter of Credit (LC)?

A Letter of Credit (LC) is an undertaking by Buyer/Importer’s (Buyer) Bank to pay its suppliers (also known as Sellers/Exporters) for goods or services subject to the supplier’s compliance with the terms of the LC. As LCs offer the assurance that both parties will fulfill their obligations whilst also safeguarding suppliers against non-payment, they are used extensively in the financing of international trade for the purposes of risk mitigation and working-capital financing.

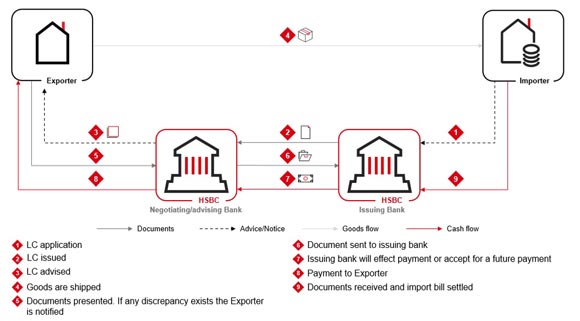

Letter of Credit Process: How does it work?

The key elements required for a LC transaction are:

- The Buyer must establish a credit facility with its Bank as the Buyer has to reimburse the Bank for issuing the LC on its behalf

- The Exporter is the beneficiary of the LC and must present documents that comply with the terms and conditions of the LC to benefit from the payment undertaking

- Payment terms can be at sight or usance (i.e. on credit terms)

- A LC is usually issued as Irrevocable which cannot be amended or cancelled without the agreement of all parties, including banks

- At a minimum, there are two banks involved in a LC transaction - the Buyer’s bank (Issuing Bank) and the Exporter’s bank (Advising/Negotiating Bank). The Exporter’s bank advises the LC to the Exporter and subsequently presents the Exporter’s documents to the Issuing Bank on the Exporter’s behalf

- LCs are governed by ICC rules – Uniform Customs and Practice for Documentary Credits (UCP 600)

A LC enables trade via a series of steps, which starts with the application of the LC and ends with fulfilment of the LC. The process begins when an Exporter agrees to provide goods or services to the Buyer, who then applies for a LC from their Issuing Bank. The Issuing Bank will use information supplied by the Buyer to create a document that outlines all pertinent details regarding the transaction, including any special conditions that must be met before payment can be made.

An Irrevocable LC is issued by the Issuing Bank to the Advising Bank, normally located in the exporter’s country. The exporter’s bank then advises the LC to the exporter.

Next, the exporter ships their goods/services and presents the LC and required documents to the Negotiating Bank, who will check the documents to ensure compliance with the terms of the LC. The Negotiating Bank sends the documents to the Issuing Bank and if all criteria have been met (as per the LC) payment will be released if it is a sight LC, or future payment is accepted if a usance LC.

If the documents are discrepant, the Issuing Bank will contact the Buyer for consent to effect payment or accept for a future payment. The Issuing Bank will release the documents to the bank upon reimbursement / acceptance of the documents by the importer. Upon receiving payment from Issuing Bank, the Negotiating Bank will pay the Exporter.

Types of Letter of Credit

There are several types of LCs available, each with its own specific purpose. These include:

Transferable LC:

- This type of LC can be transferred by the original (first) beneficiary to one or more third parties (secondary beneficiaries) and allows for substitution of drafts and invoices by the first beneficiary.

- This LC is normally used when the first beneficiary does not supply the merchandise but acts as a ‘middleman’ and wishes to transfer part or all of their rights and obligations to their suppliers, who become the secondary beneficiaries. Shipment goes directly from the secondary beneficiaries to the DC Applicant (the importer).

Revolving LC (RVLC):

- RVLCs are credits that are renewed or reinstated within their overall validity without requiring specific amendments. These are commonly used by traders that are having regular shipments from the same supplier over an extended time. RVLCs dispense with the administrative effort needed for frequent amendments.

- They may revolve around time or value:

- RVLCs revolving around time are for fixed amounts that are reinstated for each specific time period within the overall validity.

- RVLCs that revolve around value are reinstated to their original value within a given overall period of validity. This type of LC provides for automatic reinstatement upon presentation of specified documents.

Back-to-Back-LC (BBLC):

- This type of LC is issued in favour of a supplier at the request of a middleman against the security of a master LC. It is issued by the ultimate buyer’s bank.

- The terms and conditions should mirror those of the master LC as much as possible. It should be noted that the bank will need to look at multiple considerations prior to issuing the BBLC and the master LC will be held by the bank as security

Usance LC Payable at Sight (UPAS):

- For this type of LC the Issuing Bank issues a LC with usance terms that give permission to the Negotiating Bank to negotiate at sight (immediately), followed by the Issuing Bank reimbursing the Negotiating Bank for the face value of the LC (plus interest incurred) on the due date.

Benefits of a Letter of Credit

- Easy access to working capital finance for Exporters

- Improved liquidity

- Improved confidence for cross-border trade

- Payment assurance for Exporters (especially in new trade relationships) since payment is guaranteed if documents comply to the terms of LC

Using LCs as a payment mechanism, offers numerous benefits over traditional methods, such as cash payments or wire transfers, primarily due to the increased levels of protection provided for both Buyers and Exporters throughout international trade negotiations. The binding nature (irrevocability) of a LC helps reduce overall risk associated with cross border transactions and ensures timely payment in addition to availing easy access to working capital finance. Additionally, an LC is based on the worldwide standard method of international trade, backed by a globally recognised documentary process.

For an importer, a LC shows the Exporter that the importer has the ability to pay for the goods and can be tailored to meet the importer’s needs, such as terms of shipping, delivery, insurance and quality inspection. An LC provides the comfort and assurance that goods are shipped in accordance with their requirements by ensuring compliant documents are presented before the supplier is paid.

For an Exporter, an LC enables an Exporter to transfer payment risk from its Buyer to the Buyer’s bank. Hence, an LC provides a secure payment method for international trade transactions where the Exporter can derive peace of mind that payment will be received after presentation of compliant documents.

Additionally, an Exporter will be able to optimise their cash flow by using a LC to raise finance, as funds can generally be advanced against compliant documents. This is generally known as LC Discounting/Negotiation whereby the Negotiating Bank agrees to make payment in advance to the beneficiary upon receipt of compliant documents or post acceptance from the Issuing Bank.

Streamline your international workflow with HSBC's trade finance solutions

HSBC’s Trade Finance Solutions help businesses facilitate their cross-border trade by offering various risk mitigation and working capital finance propositions.

HSBC’s extensive global network combined with a comprehensive suite of services, including tailor made solutions, where required, enables us to be a trusted and reliable partner in global commerce – thereby help businesses manage their international trade with greater efficiency whilst enabling opportunity to explore new markets. Click here to contact us and find out more about our letter of credit and trade finance solutions.